The Payment Leadership Paradox: 5 Counter-Intuitive Truths Redefining the Future of Money

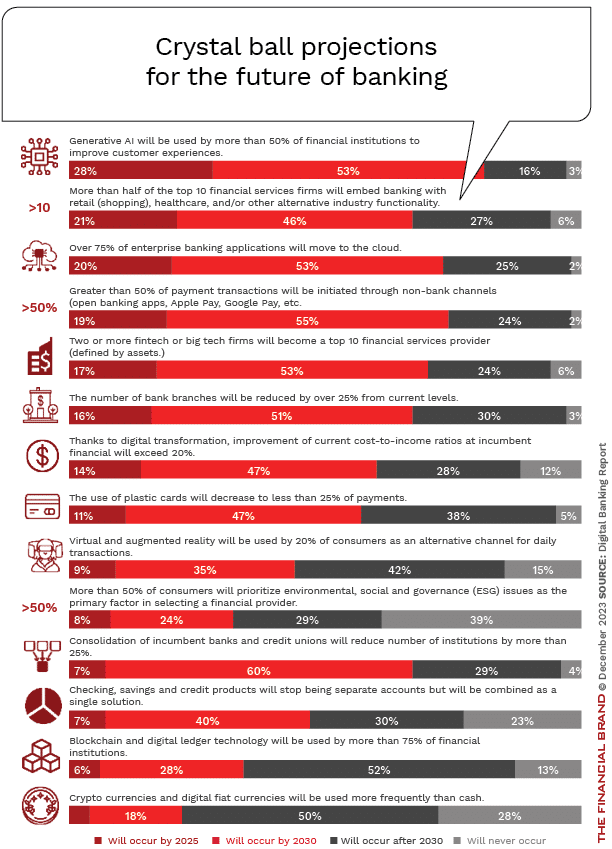

The High-Speed Illusion To the average consumer, the act of paying has reached a state of near-magic. A biometric "tap", a mobile swipe, or a background process so integrated it feels invisible—the expectation is simplicity itself. This effortless front-end experience creates a powerful "High-Speed Illusion" of industry-wide mastery. Indeed, global executives perceive payments as the second most innovative industry on the planet (81%), trailing only information technology. However, as any strategic consultant will tell you, simplicity is often the most expensive thing to build. Beneath this "tap and go" surface lies a hidden friction. The industry is currently locked in a high-stakes "push-pull" struggle: the push of real-time rails and AI-driven convenience against the pull of rigid legacy debt and sophisticated fraud. To understand the future of money, we must look past the consumer interface and confront the internal paradoxes that separate th...

.jpg)