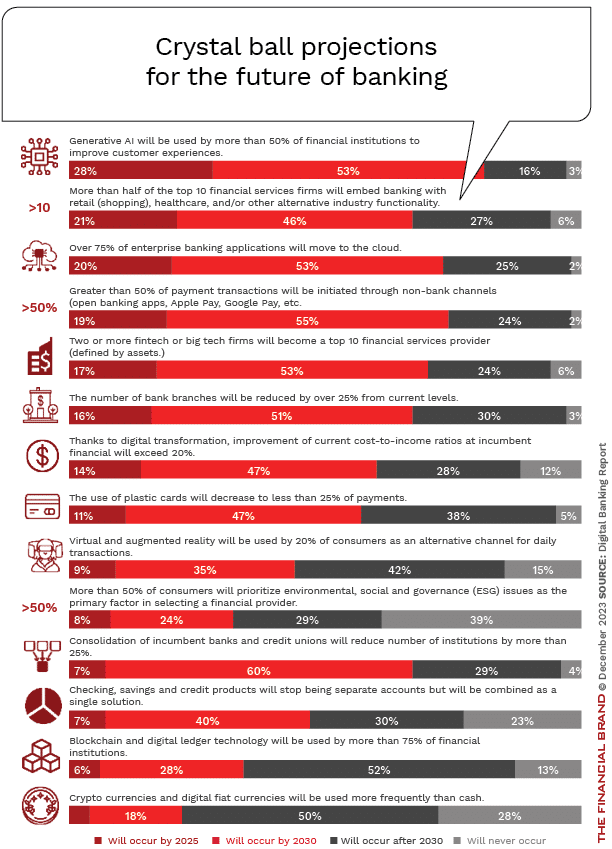

A comprehensive examination involving more than 300 insiders from the banking industry worldwide reveals intriguing and sometimes conflicting viewpoints regarding the speed and nature of forthcoming changes in retail banking in the coming years. The 2024 Retail Banking Crystal Ball research initiative collected insights from major global and national banks, regional banks, community institutions, credit unions, fintech firms, vendors, and advisors across North America, Europe, Asia, and other regions. In an effort to address pressing questions confronting financial institutions as we transition into the new year, the Digital Banking Report sought input from industry professionals to outline their projections on what the future holds and when. The study delved into 14 perspectives, as depicted in the initial chart below, spanning four pivotal areas of banking: Competition and Consolidation Modern Technologies Payments Digital Transformation Read the full article HERE .

.jpg)